who pays sales tax when selling a car privately in california

Thankfully the solution to this dilemma is pretty simple. You do not need to pay sales tax when you are selling the vehicle.

California Title Transfer How To Sell A Car In California Quick

The service use tax due is determined by the senior service employee car dealership.

. You would have to obtain the certificate of title from your lienholder in order to sell the vehicle. Retailers who make sales of services when the goods are transferred in the course of the provision of their services and which are not minimus must declare and pay the service tax on their selling price using Form ST-1 VAT return. The seller paid sales tax when they bought the car so they only pay income tax on the capital gain which is higher if they depreciated the vehicle on their taxes.

Income Tax Liability When Selling Your Used Car. Fill out all the required forms review and. The buyer pays sales tax on the purchase price of the car.

Be prepared to pay transfer title registration taxes and other fees Step 5. To calculate the sales tax on your vehicle find the total sales tax fee for the city. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Acceptable Proof of Ownership Documents Selling a New Vehicle Department of Revenue. However if you bought it for.

Do not let a buyer tell you that you are supposed to. Multiply the vehicle price after trade-in andor incentives by the sales tax fee. It depends on the length of the permit.

The buyer inspects the car Step 4. There is also between a 025 and 075 when it comes to county tax. Complete the Notice of Sale form attached to the bottom of the title and mail that in to the IL Secretary of State SOS.

A retailer who sells services is of minimus if. Get a smog certification if your car isnt exempt Step 3. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

Multiply the vehicle price before trade-in or incentives by the sales tax fee. Sales tax is charged every time a vehicle is bought or sold regardless of sales tax paid by a previous buyer. Retailers who make sales of services when the goods are transferred in the course of the provision of their services and which are not minimus must declare and pay the service tax on their selling price using Form ST-1 VAT return.

For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. Existing state residents who have purchased an out-of-state vehicle will also be required to pay the 6 percent use tax of the vehicle sale price. The minimum is 725.

The buyer will have to pay the sales tax when they get the car registered under their name. What is the state sales tax on cars in Illinois. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

The sales tax applies to transfers of title or possession through retail sales by registered dealers or. The service use tax due is determined by the senior service employee car dealership. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

Its added to the initial cost of registration. The minimum is 725. 106 Places for shopping.

The buyer will have to pay the sales tax when they get the car registered under their name. Also if the dealership handles your vehicles documentation in any capacity they may require an additional fee called a dealership documentation fee. Motor Vehicle Understated Value Program.

For example if you decide to sell privately youll need to pay off your car loan to get the lien removed from the car title so that the title can be transferred to the buyer. If you are selling your vehicle to a car dealer just as in purchasing from one all of the taxes and title fees will be taken care of by the dealer. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car. Do not let a buyer tell.

Review and gather the California DMV forms Step 2. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Per the Daily Herald if you live inside the city of Chicago you will be charged an additional city sales tax of 125. Selling a car can be done through a couple of different routes.

For example a 15000 car will cost you 99375 in state sales tax. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. The buyer will have to pay the sales tax when they get the car registered under their name.

What to do when selling a car in Illinois. Multiply the vehicle price before trade-in or incentives by the sales tax fee. If you financed the vehicle youre trying to sell the certificate of title in your name would be held by your lienholder.

A retailer who sells services is of minimus if. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

California Vehicle Tax Everything You Need To Know

Important Tax Information For Used Vehicle Dealers California Dmv

California Vehicle Sales Tax Fees Calculator

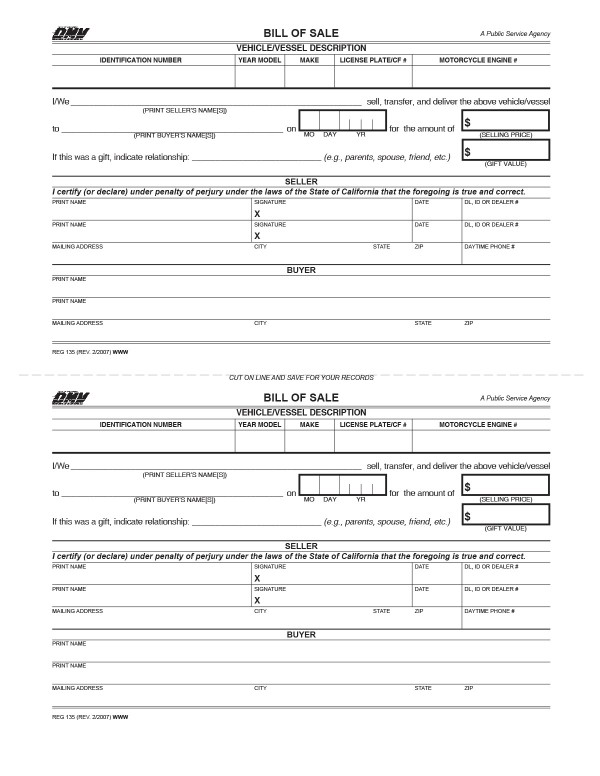

All About Bills Of Sale In California The Facts And Forms You Need

Used Vehicle California Sales Tax And California Board Of Equalization

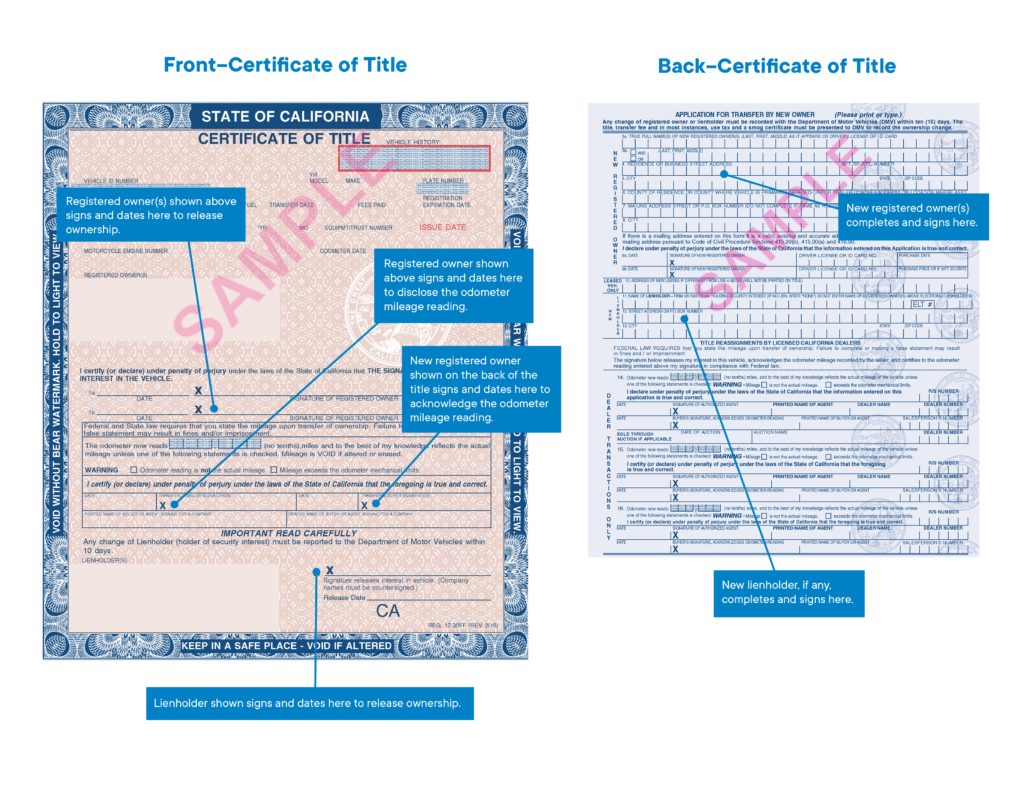

California Dmv Title Transfer Skip The Dmv Transfer Online

California Used Car Sales Tax Fees 2020 Everquote

How To Register Vehicles Purchased In Private Sales California Dmv

Used Vehicle California Sales Tax And California Board Of Equalization

California Vehicle Sales Tax Fees Calculator

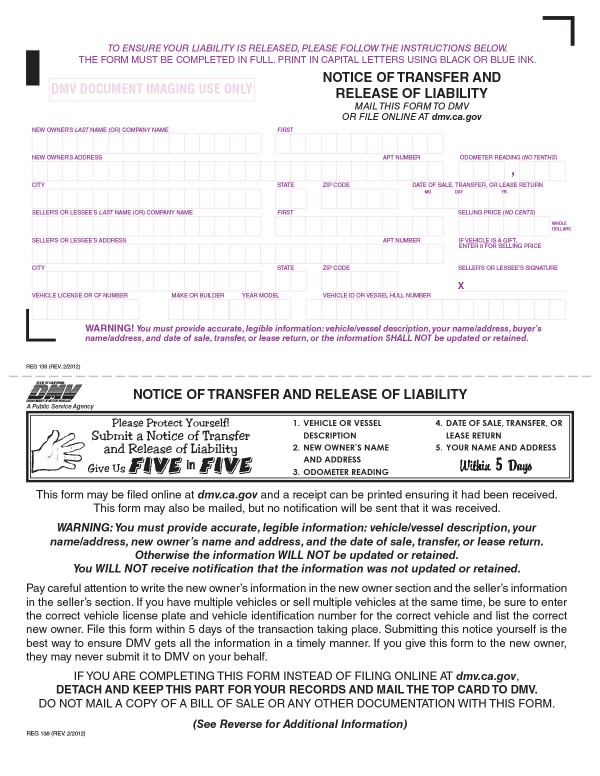

How To Release Liability Of A Vehicle In California Sfvba Referral

How Can I Add My Spouse S Name To My Vehicle Title

All About Bills Of Sale In California The Facts And Forms You Need

Can You Sell A Car In Ca That I Bought Out Of State And Is Not Registered I Have The Original Title Registration And Bill Of Sale Quora

Understanding California S Sales Tax

California Dmv Title Transfer Skip The Dmv Transfer Online

All About Bills Of Sale In California The Facts And Forms You Need

If A Car Is Sold Between Family Members Not A Gift Is There Still Sales Tax In California Quora

All About Bills Of Sale In California The Facts And Forms You Need